Companies partially owned by billionaires closely tied to Vladimir Putin continue to export their products to Western markets without disruption.

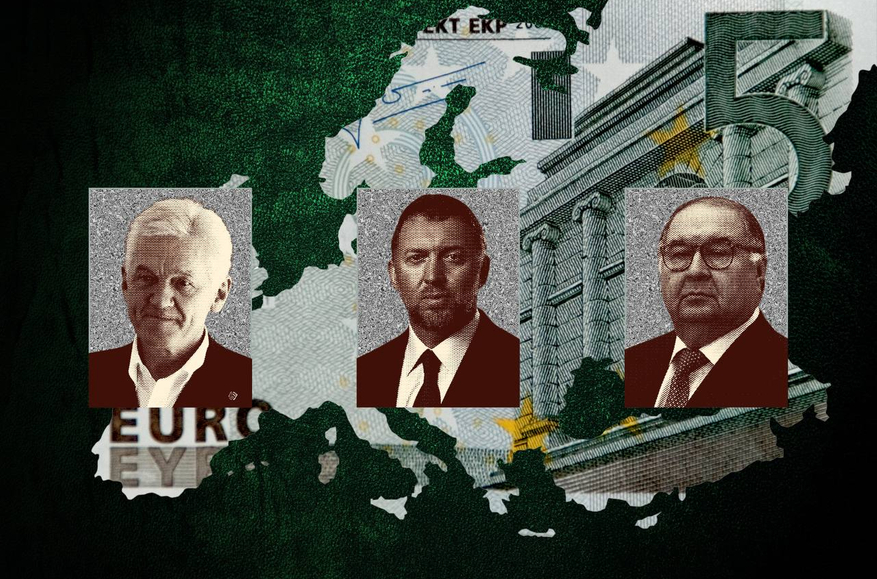

An investigation by The Insider revealed that even individuals under sanctions are earning billions from deals with EU countries. They exploit a loophole that allows firms to operate freely in EU markets so long as sanctioned individuals hold less than 50% of the company’s shares. This loophole enables some of the most controversial oligarchs, including Gennady Timchenko, Alisher Usmanov, and Oleg Deripaska, to reap massive profits from trade with Europe.

Oleg Deripaska

Sanctions against an individual do not automatically extend to that individual’s corporate assets. For such restrictions to apply, the person must control at least 50% of a company. Alternatively, if multiple sanctioned shareholders collectively own at least 50%, the sanctions also apply to the organization in question.

For instance, the EU explains that if one sanctioned individual owns 30% of a company and another owns 25%, the organization is considered to be under the ownership of sanctioned individuals. To sidestep these restrictions, some oligarchs reduce their stakes in companies. Oleg Deripaska employed this tactic, lowering his share in En+ Group, which consequently lowered his stake in Rusal, a major aluminum producer

Photo: Kommersant / Dmitry Azarov

Currently, Deripaska controls 35% of En+. En+, in turn, owns nearly 57% of Rusal’s shares.

Viktor Vekselberg, the second principal shareholder of Rusal, has managed to avoid EU sanctions and continues operating in Europe. He remains unpunished despite openly meeting with Putin during the war as part of the president’s circle of loyal businessmen. Additionally, companies linked to the oligarch are involved in manufacturing precision missiles used in strikes on Ukrainian territory.

In the first half of 2024 alone, Europe accounted for $1.3 billion of Rusal’s revenue. The company also operates production facilities in Sweden (Kubikenborg Aluminium AB), Ireland (Aughinish Alumina), Germany (Aluminium Rheinfelden), and Italy (Eurallumina).

Photo: Russian Oligarch’s Factory in Sweden

Erik Mårtensson/TT/www.dagenssamhalle.se/

Rusal exports its products from Russia to Europe primarily through its Swiss subsidiary, RS International GmbH. For example, in 2024, this subsidiary handled exports from the Bratsk Aluminum Plant and RUSAL Ural JSC. Aluminum alloys were shipped to Germany, the Czech Republic, Austria, France, the Netherlands, Italy, Slovakia, Croatia, Poland, Spain, and Estonia.

Through the Swiss firm alone, Deripaska exported over $100 million worth of products to Europe in the first half of 2024. Additionally, exports to EU countries are facilitated by companies from the UAE (Al Plus Global DMCC), Spain (C. Steinweg-Iberia S.L.), and other foreign suppliers.

Deripaska has repeatedly been at the center of scandals involving his corrupt ties to Russian authorities, including his relationship with Foreign Minister Sergey Lavrov. As previously reported by The Insider, the oligarch also has the privilege of holding a diplomatic passport. He also circumvented sanctions to purchase a French-made business jet.

On the eve of the large-scale war, Vladimir Putin promised state support for modernizing the Bratsk Aluminum Plant — the same plant producing goods that today are being exported to EU countries. Using Western funds, Deripaska finances his private military company, which is engaged in combat operations in Ukraine.

Between 2022 and 2024 — that is, during the full-scale war — Deripaska’s fortune grew by more than 50%. It now stands at $2.8 billion, according to Forbes.

Alisher Usmanov

Another method wealthy Russians use to shield a business from sanctions is to transfer shares to company managers (with an option for buyback), relatives, or other individuals that can be relied on. Alisher Usmanov, a close ally of Dmitry Medvedev, adopted a similar strategy in order to reduce his stake in USM down to 49%. Consequently, after Usmanov was added to the EU sanctions list, USM was able to quickly reassure stakeholders that the companies within the conglomerate would remain unaffected.

USM includes Metalloinvest, the largest iron ore company in Russia and the CIS. As noted by The Insider, Metalloinvest enterprises export their products to European countries.

Lebedinsky Mining and Processing Plant

For instance, in the first six months of 2024, the Lebedinsky Mining and Processing Plant sold around $150 million worth of products to Italy, Spain, and Poland. Hot-briquetted iron was shipped to the West via Orex Intertrade (Uzbekistan) and BFM Steel Trading (Dubai).

Usmanov’s partner in Metalloinvest is State Duma deputy Andrei Skoch of the ruling United Russia party. Skoch is under sanctions, but the business is registered under his father, Vladimir, and daughter, Varvara — neither of whom is subject to EU restrictions. Varvara Skoch, who holds Cypriot citizenship, is married to the son of Denis Manturov, Russia’s First Deputy Prime Minister. The Skoch family business — and, by extension, Usmanov’s — enjoys the patronage of both the government and Manturov personally.

Since the start of the full-scale war, the fortunes of Usmanov and the Skoch family have only grown, reaching $13.4 billion and $6.7 billion, respectively. Combined, they have gained nearly $4 billion over the past two years.

Andrey Guryev and Vladimir Litvinenko (Author of Putin’s Dissertation)

PhosAgro, Russia’s largest producer of phosphate fertilizers, is 48.5% owned by the family of sanctioned oligarch Andrey Guryev.

Guryev meeting with Putin in April 2023

Guryev was once a business partner of Mikhail Khodorkovsky. The two met in the late 1980s while working together in Moscow’s Frunze District Komsomol Committee. After founding the bank Menatep, Khodorkovsky invited Guryev to join the project, offering him a role in managing real estate privatization. In 1994, when Menatep-linked entities privatized the Apatit mining enterprise, Khodorkovsky tasked Guryev with overseeing the operation.

Alongside his business ventures, Guryev became a member of United Russia and served as a senator in the Federation Council for nearly 12 years, from 2001 to 2013. Khodorkovsky’s arrest in 2003 did not disrupt Guryev’s career. Instead, he found a new notable partner: Vladimir Litvinenko, rector of Saint Petersburg Mining University — better known as the actual author of Vladimir Putin’s fabricated dissertation.

Litvinenko and Putin

Litvinenko supervised Putin’s graduate thesis and later managed Putin’s campaign offices in St. Petersburg for the 2000, 2004, 2012, and 2018 presidential elections. In the 2024 election, he acted as a trusted representative for the candidate. Guryev has known Litvinenko since the early 2000s, and it was Guryev who initiated their partnership. “I think [Litvinenko] was brought into PhosAgro to signal the company’s loyalty to Putin — as a friend,” Litvinenko’s daughter once remarked.

Litvinenko and his wife Tatyana, to whom he transferred over 20% of PhosAgro’s shares in 2022, are not subject to EU sanctions. As a result, PhosAgro continues to freely export its products to Europe.

According to customs data obtained by The Insider, Apatit JSC supplies feed phosphates and other products to the Netherlands, Hungary, France, Germany, Greece, and Romania. Its customers include companies such as PureFert Trading AG (PhosAgro’s Swiss subsidiary), Purefert Balkans D.O.O. (Serbia), PureFert Deutschland GmbH (Germany), Purefert France SAS (France), and Bige Holding Kft (Hungary).

Fertilizer trade during the war has proven lucrative for Putin’s trusted associate. Vladimir Litvinenko’s fortune has doubled since 2022, reaching $3 billion.

Vladimir Litvinenko’s fortune has doubled since 2022, reaching $3 billion

And the Guryev-Litvinenko story is not unique. Another fertilizer supplier to Europe is EuroChem, owned by oligarch Andrey Melnichenko, who reduced his stake in the company after being sanctioned. In April 2024 alone, EuroChem-Northwest JSC shipped 23 tons of liquefied anhydrous ammonia to Belgium.

In the same month, Kovdor Mining and Processing Plant JSC sent apatite concentrate worth over $5 million to Lithuania. Customs documents list AB Lifosa, a Lithuanian subsidiary of EuroChem, as the recipient, though the government in Vilnius has since placed the company under temporary administration. Melnichenko’s products are also exported to Slovenia, Italy, France, Romania, Greece, Germany, and Spain.

Roman Abramovich

Roman Abramovich’s three daughters and son own an estate in Saint-Tropez. Meanwhile, the oligarch’s company, Evraz, exports continuously cast slabs to France, with the shipments originating from the Nizhny Tagil Metallurgical Plant.

Abramovich holds a 28.64% stake in Evraz, a major steel and mining corporation. In addition to France, Evraz facilities exported products to the Czech Republic in 2024. Among the recipients was Czech Vanadium, a Czech factory that claimed to have exited the Evraz group but, as customs data show, continued to receive Abramovich’s products.

Abramovich is also a minority shareholder in Norilsk Nickel (Nornickel). Within the company, he acts as a “guarantor” of agreements between other major shareholders, namely Vladimir Potanin and Oleg Deripaska. Potanin, Nornickel’s primary owner, has not been sanctioned by the European Union. As a result, Russia’s mining and metallurgical industry leader continues to export — and even operates production facilities in Europe.

Activist protest at the Norilsk Nickel Harjavalta plant in Finland

Gennady Timchenko

Known as Vladimir Putin’s “wallet,” Gennady Timchenko serves as a junior partner to billionaire Leonid Mikhelson. Timchenko holds significant stakes in natural gas producer Novatek (23.49%) and petrochemicals company Sibur (17%). But Mikhelson, the majority owner of these companies, is not subject to EU sanctions — meaning that the entities generating profits for Timchenko also remain unaffected by restrictions.

The Insider previously demonstrated how Sibur, closely linked to Putin, exports products to Europe via its Austrian subsidiary, SIBUR International GmbH. Following the report, Austrian authorities froze the accounts of companies tied to Putin’s allies. However, Sibur successfully overturned this decision in court, citing the fact that sanctioned individuals hold less than 50% of the company’s shares.

Putin and Timchenko applauding the Vienna court’s decision

Mikhelson has evaded EU sanctions despite himself having close ties to Putin. His connection is evident from the recent involvement of Putin’s son-in-law, Yevgeny Nagorny, in supervising the construction of a Novatek gas pipeline in the Murmansk region. Moreover, Mikhelson has been a key sponsor of Russian volunteer fighters in the war against Ukraine.

Another minor Sibur shareholder avoiding European sanctions is Putin’s nephew, Mikhail Shelomov, who assists in concealing assets and evading sanctions. Although Shelomov plays an unmistakable role in Putin’s corruption network, only the United Kingdom has imposed sanctions on him.

As a result, Putin’s inner circle continues to benefit from trade with European countries. In 2024, the Cryogas-Vysotsk plant, a joint venture between Novatek and Gazprombank, exported liquefied natural gas to Belgium through the Swiss company NOVATEK Gas and Power Asia Pte. Additionally, Sibur’s subsidiary, LLC NHTK, supplied technical-grade propane-butane and other products to Malta, Poland, Latvia, the Netherlands, Slovakia, Romania, Hungary, and other European nations. According to customs data, NHTK exported $119 million worth of goods to EU countries during the first half of 2024.